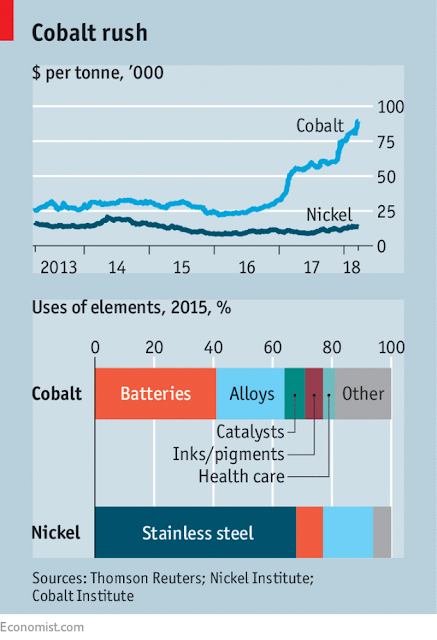

There

is an ongoing boom in the materials supply chain industry to supply the

Electrical Vehicle manufacturers with battery materials. There are a

number of concerns in the supply of the actual materials (e.g. Lithium,

Cobalt and graphite). The technological aspects are also still broad,

however it seems very likely that ALD will play a role for some of the

technologies for producing future lithium batteries that we will use in

basically all devices ranging from communication (smart phones) and for

transportation (cars, trucks, trains, ships, airplanes).

Alumina ALD Coating on LiCoO2

cathode particles showing a clear improvment in battery cyclability.

The ALD coated material (red) shows improved capacity retention compared

to uncoated (black). (ALD Nano)

ALD

Nano in Boulder Colorado is the pioneer in this technology area and has

recently announced scaling up their technology to run high volume of

powder (3000 kg/day). They have developed a Spatial vibrationg

technology refered to as Continious Vibrating Reactor - CVR.

The scientific, process development and engineering teams at ALD Nano

have spent considerable resources over the past few years rapidly

developing this first-of-its-kind technology from research scale,

bench-top to the current commercial-scale systems. A continuous

vibrating reactor, or CVR, provides ALD coating capacity of more than

three tons per day and 1,200 tons per year of particle materials. These

techniques gained from equipment development open up new pathways for

ALD Nano's growth. The CVR is a spatial ALD reactor system and can also

be utilized for MLD techniques, run at atmospheric or pressurized

conditions, and fitted with various features such as plasma. [LINK]

It

seems to me that their technology is mature for high volume

manufacturing of powder materials and that they "simply" by scaling the

number and/or the size of plants can supply the know how and hardware

for full scale production for any big player in the battery materials

supply chain.

ALD

Nano was recently highlighted by the Colorado Cleantech Industries

Association (CCIA) and here is the information given by their CEO, Wayne

Simmons:

Battery Breakthrough Company Feature: ALD NanoSolutions

CCIA [

LINK] : We asked several companies “What are the critical changes in the battery

industry landscape that will have a strategic impact on your success?”

This week, we’re highlighting

ALD NanoSolutions.

Wayne Simmons, CEO

Lithium

ion batteries for electric vehicles, consumer electronics, and

distributed energy storage, along with new versions of lead acid

batteries for vehicle start-stop fuel efficiency strategies, are driving

today’s growth in the battery energy storage market. Longer term,

grid-scale batteries will generate a large impact too. Overall, the

dramatic changes and expansion of the battery industry are creating huge

new materials markets. Every major chemical and advanced materials

company in the world is attracted to this opportunity. However, for new

devices like EVs to take meaningful market share, the materials for

electrodes, electrolytes, and other battery components need to be

engineered at the nanometer, or even atomic, scale. It is this demand

for engineering new materials that improve energy storage, safety, and

power management metrics, combined with the desired cost stack of inputs

to the final battery price, that has a big impact on ALD Nano’s

business. The key for us to succeed is to enable the new battery

materials with atomic layer deposition technologies that not only solve

various technical challenges to reach performance metrics, but can also

scale at very low cost.

About ALD NanoSolutions ALD NanoSolutions (ALD Nano) is creating cost-effective advanced

materials through its unique portfolio of atomic layer deposition

technologies to transform industries.

.jpg/1200px-Robert_Bosch_GmbH_Zentrum_f%C3%BCr_Forschung_und_Vorausentwicklung_-_panoramio_(11).jpg)