It is widely known that more than half of the world’s cobalt reserves and production are in one dangerously unstable country, the Democratic Republic of Congo. What is less well known is that four-fifths of the cobalt sulphates and oxides used to make the all-important cathodes for lithium-ion batteries are refined in China. (Much of the other 20% is processed in Finland, but its raw material, too, comes from a mine in Congo, majority-owned by a Chinese firm, China Molybdenum.)

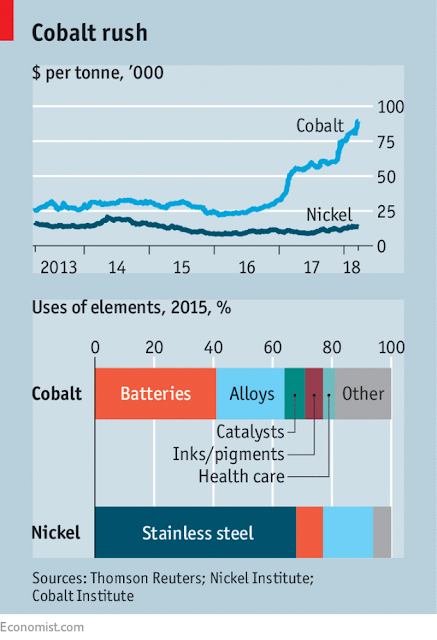

On March 14th concerns about China’s grip on Congo’s cobalt production deepened when GEM, a Chinese battery maker, said it would acquire a third of the cobalt shipped by Glencore, the world’s biggest producer of the metal, between 2018 and 2020—equivalent to almost half of the world’s 110,000-tonne production in 2017. This is likely to add momentum to a rally that has pushed the price of cobalt up from an average of $26,500 a tonne in 2016 to above $90,000 a tonne.

It is not known whether non-Chinese battery, EV or consumer-electronics manufacturers have done similar, unannounced deals with Glencore.

But Sam Jaffe of Cairn Energy Research Advisors, a consultancy, says it will be a severe blow to some firms. He likens the outcome of the deal to a game of musical chairs in which Chinese battery manufacturers have taken all but one of the seats. “Everybody else is frantically looking for that last empty chair.”

Mr Jaffe doubts the cobalt grab is an effort by Chinese firms to corner or manipulate the market for speculative ends. Instead, he says, they are likely to be driven by a “desperate need” to fulfil China’s ambitious plans to step up production of EVs.

Full Article: LINK

.jpg/1200px-Robert_Bosch_GmbH_Zentrum_f%C3%BCr_Forschung_und_Vorausentwicklung_-_panoramio_(11).jpg)